$CRSR: Primed and waiting to fly

- u/randomhardo

- Apr 24, 2021

- 1 min read

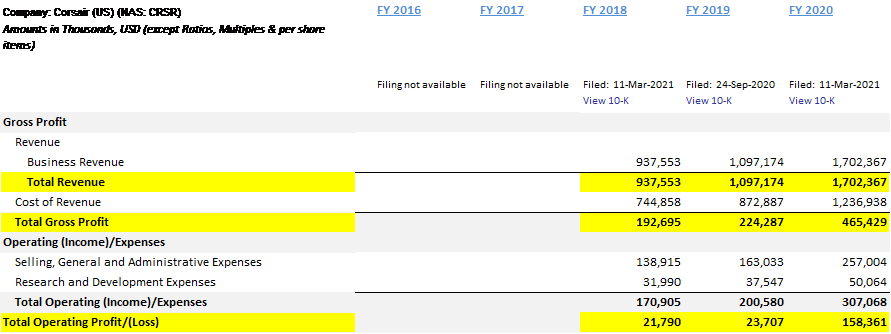

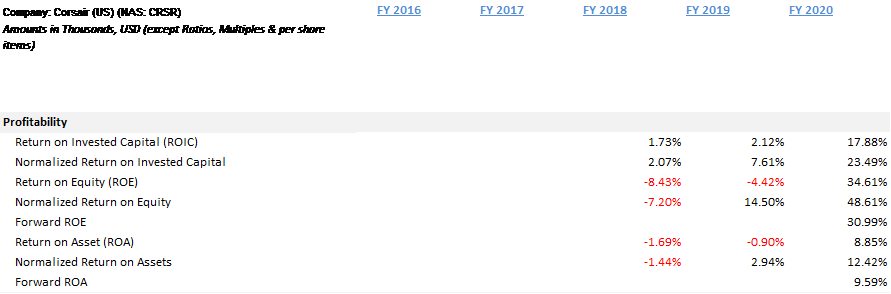

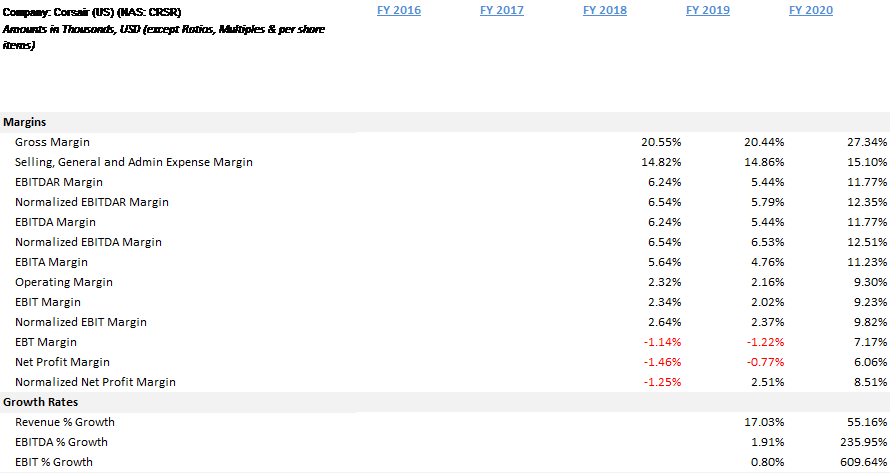

So my readers, this would be my thesis on why Corsair will go on a bull run in the months to come. Firstly, take a look at the financials, that’s pretty rock solid in this day and age

Conversative Assumptions Still Points to a 30% discount

Growth of Gaming, Streaming, and Esports

Gaming is not going away after Covid-19. In 2020, worldwide gaming sales hit a record $180B. This is more than the combined sales of the global film industry and US professional sports in 2019. Covid-19 may have accelerated growth in this sector, but gaming sales grew from $140B to $150B between 2018 and 2019, and the market is projected to hit $287B by 2026.

Dominant Market Position

$CRSR has top market share in high performance memory, power supply units, and cooling solutions (all core products for Corsair), while it is number two in keyboards, streaming peripherals, performance controllers, and cases (growth is largely attributed to acquisitions.)

Bull Case

Growth in the gaming market has been headlined by the explosion of two trends: streaming and Esports.

Corsair trades at a conservative valuation, and all IPO-related lock-up periods have now expired.

Strong Fundamentals

Bear Case

Losing market share to key competitors such as Logitech (LOGI), Razer (OTCPK:RAZFF)

Increased adoption of cloud gaming could decrease future demand for high-performance gaming PCs. (if you believe in Google Stadia)

Reversal in growth trends within the gaming market

Comments